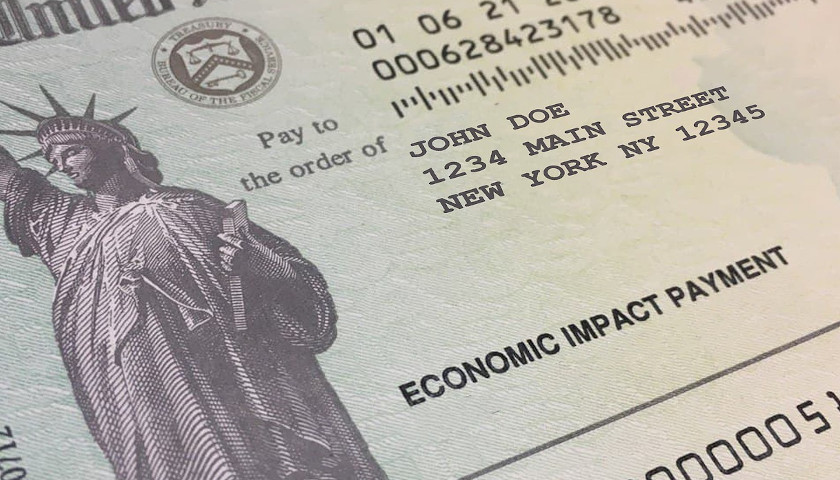

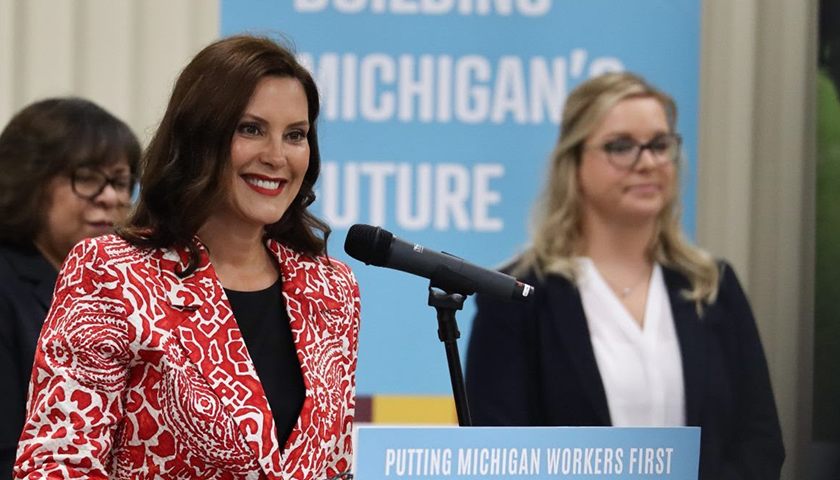

Gov. Gretchen Whitmer is calling for the Michigan Catastrophic Claims Association to refund $5 billion in surplus funds to Michigan automotive insurance customers.

“My office recently reviewed the Annual Report of the Michigan Catastrophic Claims Association (MCCA) to the Legislature issued in September 2021,” the governor wrote in a Nov. 1 letter addressed to R. Kevin Clinton, MCCA executive director. “The report stated that the MCCA had a surplus of $2.4 billion at the end of 2020. In your annual statement issued on June 30, 2021, the surplus is now $5 billion. I am calling on you today to refund money to Michiganders.”

The governor attributes the surplus to the bipartisan Senate Bill 1 insurance reform bill she signed in May 2019. Provisions of the bill include:

Guaranteeing lower rates for drivers for eight years;

Giving people the choice to pick their own Personal Injury Protection (PIP) options with coinciding PIP rate reductions, offering unlimited coverage (at least 10% PIP reduction), $500,000 coverage (at least 20% PIP reduction), $250K coverage (at least 35% PIP reduction), $50,000 coverage for Medicaid eligible recipients (at least 45% PIP reduction), or a complete opt out for seniors or anyone with sufficient private insurance (100% PIP reduction).

Increasing consumer protections by banning companies from using the following non-driving factors to set rates: ZIP code, credit score, gender, marital status, occupation, educational attainment, and homeownership.

Setting fee schedules for hospitals and providers to prevent overcharging for auto-related injuries.

Read More