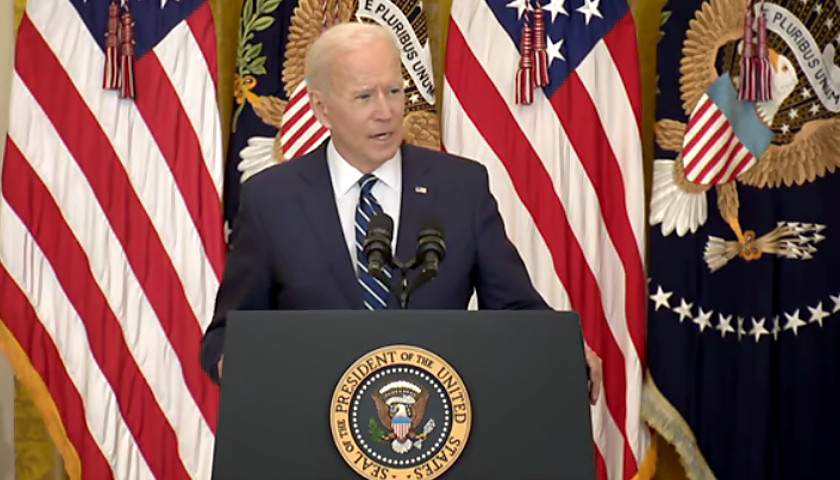

Benjamin Franklin famously wrote in 1789 that “our new Constitution is now established and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes.” Death and taxes are fated. However, are enormous tax hikes also a fait accompli? Is it a certainty – ‘an accomplished fact’ – that the White House and Congress will repeal tax reforms that worked? Tax breaks that helped small business owners and families.

For the past several days Americans have been scrambling to make the deadline to complete their 2022 tax returns. Most taxpayers will be relieved once the ordeal is done. However, here’s an unfortunate reality: if Washington fails to act, the federal tax code is headed for major changes in just a couple of years, including massive tax hikes on families and small businesses.

Read More