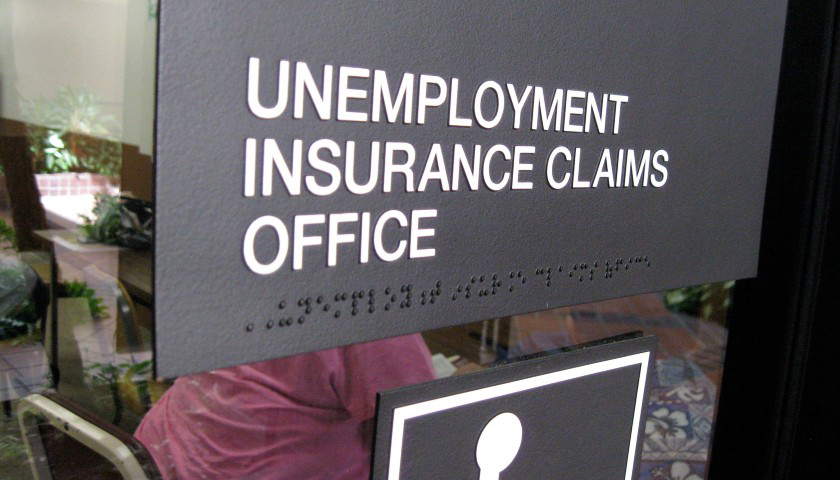

House lawmakers are set to return from recess Monday and will likely take up the $1.2 trillion bipartisan infrastructure bill the Senate passed last week — and with it, a controversial and last-minute cryptocurrency tax provision.

The bill contains a tax reporting mandate forcing cryptocurrency “brokers” to disclose gains and transactions to the Internal Revenue Service (IRS) as part of a scheme designed to help cover part of the infrastructure bill’s cost. However, the bill’s definition of “broker” has been criticized by the cryptocurrency community and pro-crypto lawmakers as vague, expansive and potentially unworkable, with many fearing it could stifle the industry and force crypto companies to collect personal information on their customers.

The provision defines a broker as “any person who is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person,” and forces brokers to report transactions to the IRS in a form similar to a 1099. This means brokers have to collect and report customer information such as names, addresses, and taxpayer identification numbers.

Read More