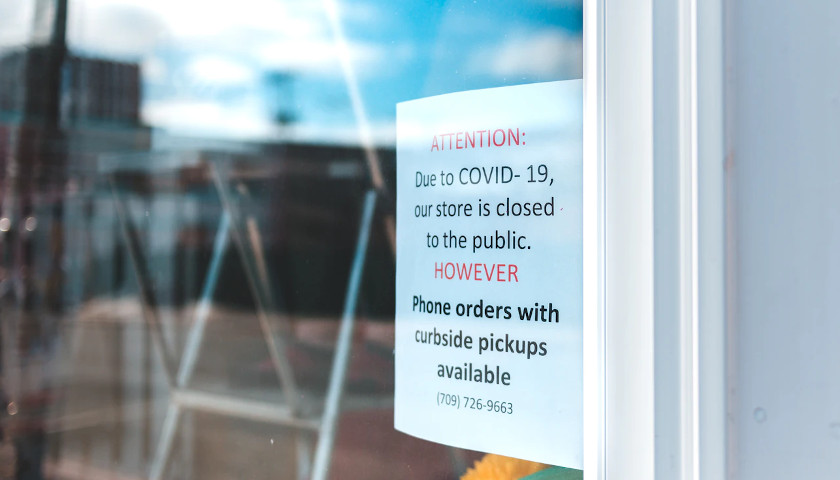

Due in large part to government edicts, religious, social, and political gatherings, have been cancelled or drastically altered to meet government requirements. Schools and colleges have closed so there will be no proms or graduations to attend this spring. Restaurant dining rooms are closed, as are community centers, fitness centers, salons, barbershops, theaters, retail stores, and malls. Theme parks, beaches, and even some public parks are closed. Air travel and the use of public transportation has declined precipitously. Traffic on the roads is eerily light, and parking lots are nearly empty.

Of the businesses that have remained open, many have reduced their operating hours. While one can reasonably expect that stay-at-home orders will reduce Chinese coronavirus cases, it remains to be seen what the human and economic toll of these orders will be; but we do know that they are devastating to small businesses and their employees.

Read More