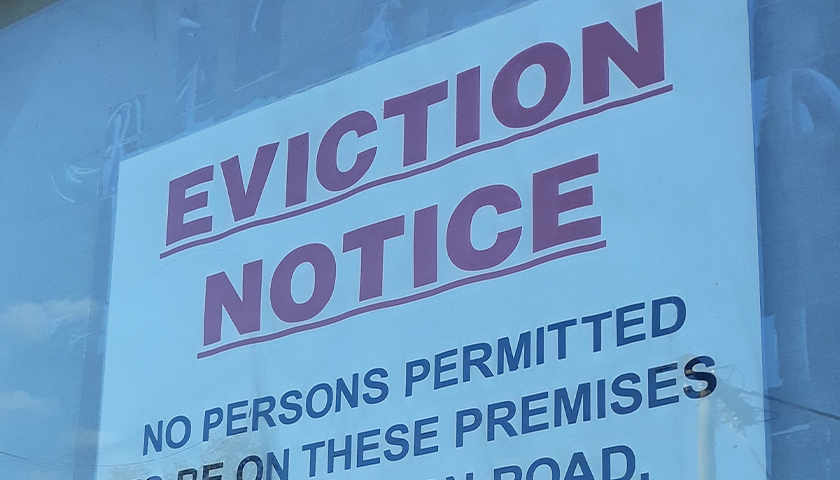

A federal judge in Washington, D.C., ruled Friday against a challenge to President Joe Biden’s latest eviction moratorium.

U.S. District Judge Dabney Friedrich denied a request from the Alabama and Georgia association of Realtors to overturn an eviction moratorium from the U.S. Centers for Disease Control and Prevention. The 60-day order bans landlords from evicting tenants, even if they do not pay rent, citing concerns over the spread of COVID-19.

“About half of all housing providers are mom-and-pop operators, and without rental income, they cannot pay their own bills or maintain their properties,” National Association of Realtors President Charlie Oppler said. “NAR has always advocated the best solution for all parties was rental assistance paid directly to housing providers to cover the rent and utilities of any vulnerable tenants during the pandemic. No housing provider wants to evict a tenant and considers it only as a last resort.”

Read More