There will always be munis. Income from municipal bonds typically enjoys tax-free status at the federal level and in the issuing state. Conversely, when investors put wealth to work in a startup, private corporation, or public company, they face a capital gains tax penalty if their investment bears fruit. If a home run, that penalty becomes enormous.

Imagine that. Investors who subsidize the growth of government largely avoid taxation. But if they back an innovative corporation, or rush a distant future into the present through an intrepid investment with a visionary entrepreneur, a major IRS bill awaits.

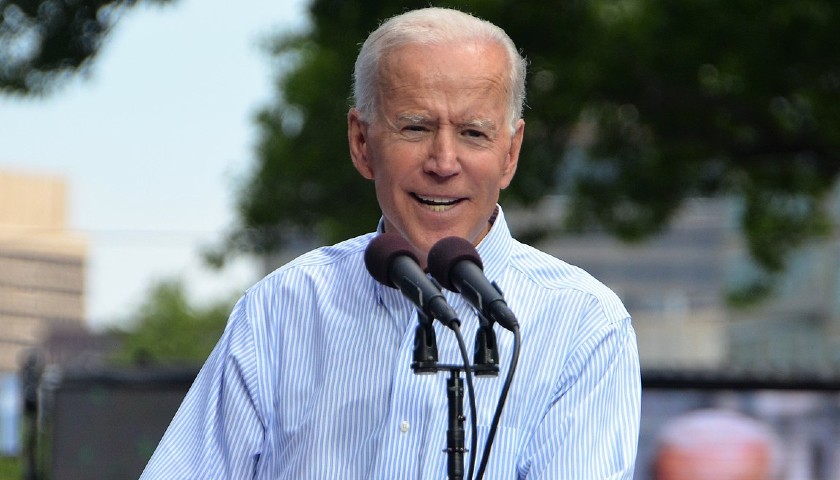

Worse, the cost of prescient investing may soon increase. Seemingly in a bid to placate his ravenous left flank, President Biden has announced a proposal to nearly double the federal penalties on savings and investment to 43.8%.

Read More