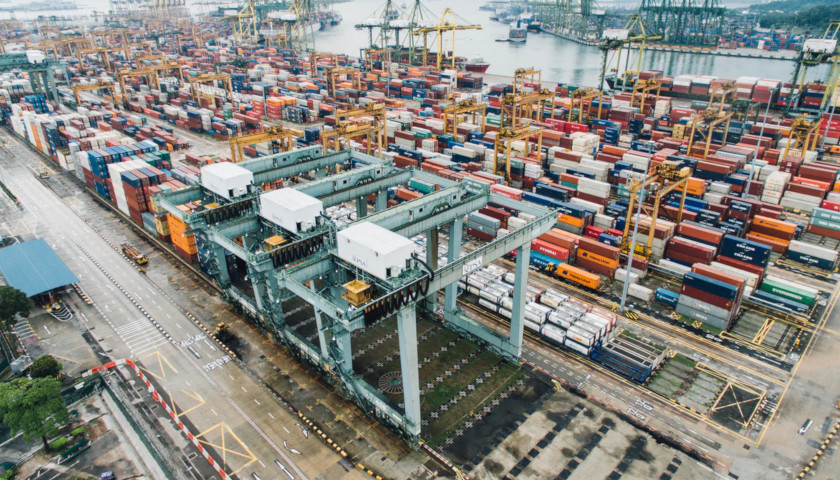

In the 2016 Republican Party presidential primary, decades of dissonance between the party’s aggrieved grassroots and its blinkered elite spilled out into the open. For years, the chasm widened between the GOP’s heartland base, the river valley-dwelling “Somewheres” from David Goodhart’s 2017 book, The Road to Somewhere, and the party’s bicoastal “Anywhere” rulers. The foot-soldier Republican “Somewheres,” disproportionately church-attending and victimized by job outsourcing and the opioid crisis, felt betrayed by the more secular, ideologically inflexible Republican “Anywheres.”

Donald Trump, lifelong conservative “outsider” and populist dissenter from bicoastal “Anywhere” orthodoxy on issues pertaining to trade, immigration, and China, coasted to the GOP’s presidential nomination. He did so notwithstanding the all-hands-on-deck pushback from leading right-leaning “Anywhere” bastions, encapsulated by National Review magazine’s dedication of an entire issue to, “Against Trump.” Trump’s subsequent victory in the 2016 general election sent the conservative intellectual movement, as well as the Republican Party itself, into a deep state of introspection.

Read More