The retail giant Big Lots on Thursday announced it was commencing a company-wide “going out of business” sale at all of its locations, marking another major business that went belly-up during President Joe Biden’s administration.

Read MoreTag: bankruptcy

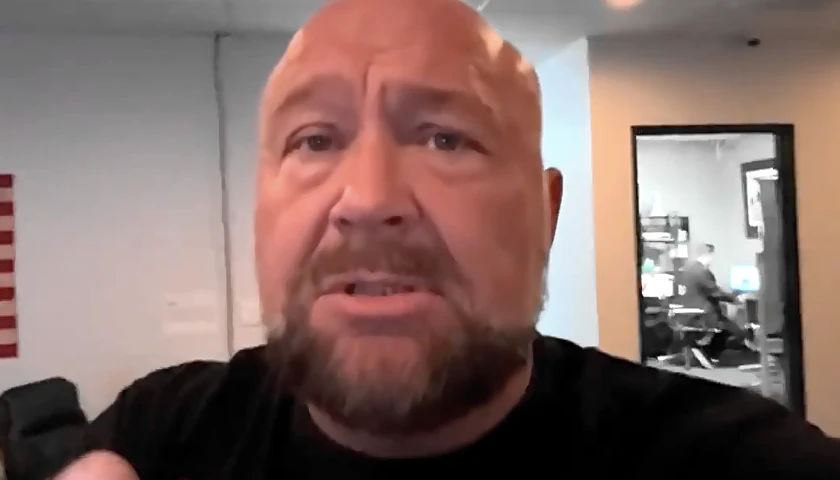

Satirical News Site ‘The Onion’ Buys Alex Jones’ Infowars Network

The Onion, a satirical news company mocking current events and news personalities, purchased Alex Jones’ Infowars network in a bankruptcy auction Thursday held to help pay off a nearly $1.5 billion lawsuit.

Read MoreDiscount Retailer Big Lots Announces Doors Will Stay Open Through Chapter 11 Bankruptcy, Sale to Nexus Capital Management

Big Lots said Monday the retail discount chain is filing for bankruptcy, citing such factors as high inflation and interest rates.

Read MoreEV Start-Up Files for Bankruptcy One Year After Rolling Out Its First Model

An electric vehicle (EV) producer that was once a splashy start-up company has filed for bankruptcy.

Fisker filed for Chapter 11 bankruptcy on Tuesday after trying and failing to secure more investment to stay afloat, the company announced. The company once attracted robust interest and hype, marketing itself as the Apple of vehicles, but it struggled to run as a public company and was stuck with thousands of EVs that it did not sell, according to The Wall Street Journal.

Read MorePossible Bankruptcy for EV Maker Fisker as Industry Hit with Declining Consumer Interest

Electric-vehicle startup Fisker may file for bankruptcy as the declining pace of consumer demand weighs upon the struggling company.

In a March 15 8-K filing with the Securities and Exchange Commission, the company warned investors that “Fisker did not make a required interest payment of approximately $8.4 million payable in cash on March 15, 2024 (the “Interest Payment”) with respect to Fisker’s unsecured 2.50% convertible notes” and that “the Company has a 30-day grace period to make the Interest Payment.”

Read MoreMassive Chinese Wealth Management Firm Files for Bankruptcy amid Real Estate Crisis

Top wealth manager Zhongzhi Enterprise Group declared bankruptcy on Friday after failing to pay its debts due to its heavy investment in the country’s struggling real estate market.

Zhongrong International Trust, a subsidiary of the company, told investors in November 2023 that it had at least $31 billion more in liabilities than in assets, previously having around $108 billion in assets at the end of 2022, according to The Wall Street Journal. The trust held around 11% of its assets in the property sector in 2022, with numerous developers defaulting amid a real estate crisis that began following the COVID-19 pandemic.

Read MoreRudy Giuliani Files for Bankruptcy, Citing Liabilities of up to $500 Million: Court Filing

Former Trump attorney Rudy Giuliani filed for bankruptcy Thursday in New York, citing that he has up to $500 million in liabilities, according to a new court filing that comes after he was ordered to pay $148 million in the defamation case filed by Georgia election workers.

Read More$700 Million in Pandemic-Era Loans Was Not Enough to Save Yellow Corp. Trucking

Trucking company Yellow filed for Chapter 11 bankruptcy on Sunday after receiving more than $700 million in COVID-19 pandemic program loans from the federal government, according to a press release from Yellow.

The 99-year-old company ceased operations of its more than 12,000 trucks on July 30, ending its less-than-truckload business, a shipping service that does not require a whole truck to be filled and was utilized by companies like Walmart, Amazon and small businesses that did not have enough freight to ship in a full truck. The bankruptcy follows a history of financial trouble, with the company receiving $729.2 million in pandemic-era loans from the Trump administration in 2020, and had a total debt of $1.5 billion, according to The Associated Press.

Read MoreMusk Tells Twitter Staff ‘Bankruptcy Isn’t Out of the Question’ as Executives Leave over Privacy Concerns: Report

At an all hands meeting with Twitter employees following the departure of several top executives over user privacy concerns, CEO Elon Musk told employees that he was not sure of the company’s financial prospects, saying that “bankruptcy isn’t out of the question,” according to multiple reports.

At the same meeting, Musk also told employees that if they can “physically make it to an office and you don’t show up, resignation accepted,” Zoë Schiffer, the managing editor of tech newsletter Platformer, alleged in a thread on Twitter Thursday afternoon. The news comes after reports that a variety of high-level executives, including Chief Privacy Officer Damien Kieran, Chief Information Security Officer Lea Kissner — who also confirmed her departure in a Thursday tweet — and Chief Compliance Officer Marianne Fogarty all resigned Thursday in response to concerns that Musk was sacrificing user’s data security for profits, according to The Verge, citing anonymous sources and the company’s internal messages.

Read MoreCommentary: Prosecution of Project Veritas Sounds Warning About Two-Tier Justice and Big State Corruption

Whatever else can be said about the FBI’s vendetta against James O’Keefe and Project Veritas, his investigative journalism enterprise, it is a useful reminder of two things: 1) that we increasingly live in a two-tier society in which the lower tier can expect the arbitrary intrusion of all the coercive elements of the state, and 2) that the fundamental legitimacy of many important American institutions is draining away rapidly like a full bathtub that is suddenly unplugged.

Scott Johnson at Powerline has an excellent summary of the case thus far.

Last Thursday, the FBI conducted a raid against two former employees of Project Veritas.

A few days later, they conducted a dawn raid against O’Keefe himself. It was the full monty.

Read MoreBrooks Brothers Files for Bankruptcy After 202 Years of Business

Brooks Brothers, one of the United States’ oldest and most prestigious retailers, filed for Chapter 11 bankruptcy Wednesday after 202 years, CNBC reported.

The retailer, credited with dressing 40 U.S. presidents since its founding in 1818, had already been burdened with rising rent when it was devastated by the coronavirus pandemic, which sunk the company’s potential sale, according to CNBC.

Read MorePG&E Exits Bankruptcy, Pays $5 Billion into Wildfire Fund

Pacific Gas & Electric has emerged from a contentious bankruptcy saga that began after its long-neglected electrical grid ignited wildfires in California that killed more than 100 people.

The nation’s largest utility announced Wednesday it emerged from Chapter 11 bankruptcy and paid $5.4 billion in initial funds and 22.19% of its stock into a trust for victims of wildfires caused by its outdated equipment.

Read MoreJudge to Approve $58 Billion Plan to End PG&E Bankruptcy After Wildfires, Pay $25.5 Billion for Losses

A federal judge on Friday said he was approving a $58 billion plan by the nation’s largest utility to end a contentious bankruptcy saga that began after Pacific Gas & Electric’s outdated equipment ignited wildfires in California that killed more than 100 people, wiped out entire towns and led the company to confess to crimes driven by its greed and neglect.

The decision by U.S. Bankruptcy Judge Dennis Montali clears the way for PG&E to pay $25.5 billion for losses from devastating fires in 2017 and 2018. The judge said he will sign the formal order confirming PG&E’s plan late Friday or Saturday after the company’s lawyers make a few minor revisions worked out during a two-hour hearing.

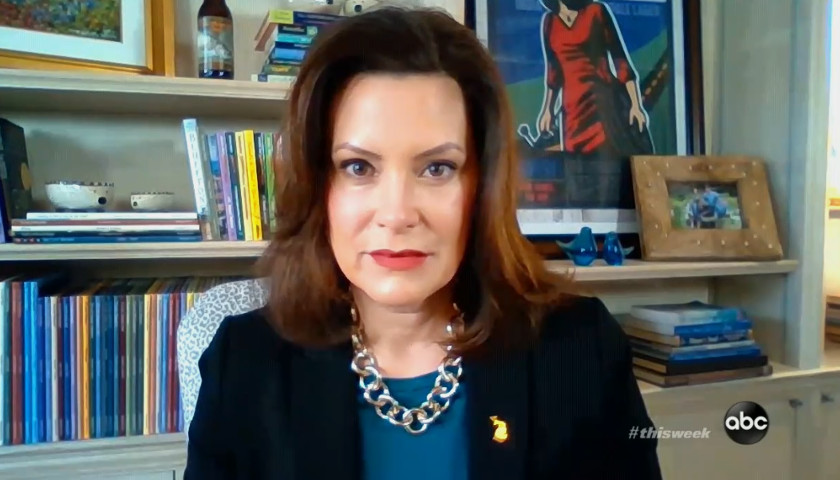

Read MoreGov. Whitmer on Bankruptcy Comments: ‘It’s Outrageous for Senator McConnell to Even Suggest That’

Gov. Gretchen Whitmer said Sunday that bankruptcy is not an option for Michigan in response to comments last week from U.S. Senate Majority Leader Mitch McConnell.

Whitmer appeared on ABC’s “This Week with George Stephanopoulos” on Sunday. Stephanopoulos asked her if default was on the table for Michigan.

“No, and it’s outrageous for Senator McConnell to even suggest that,” Whitmer said. “But that’s what the matter is. Our general fund budget when adjusted for the inflation is the same size it was during – when Richard Nixon was our president. We have been incredibly smart stewards and we have not made some of the investments I think we should have as a state because of this artificially low number that we’ve been working with.”

Read More