The environment, social and governance (ESG) investing movement has faced a lot of criticism over the past couple years for undermining fiduciary responsibility and pushing progressive agendas through an undemocratic process.

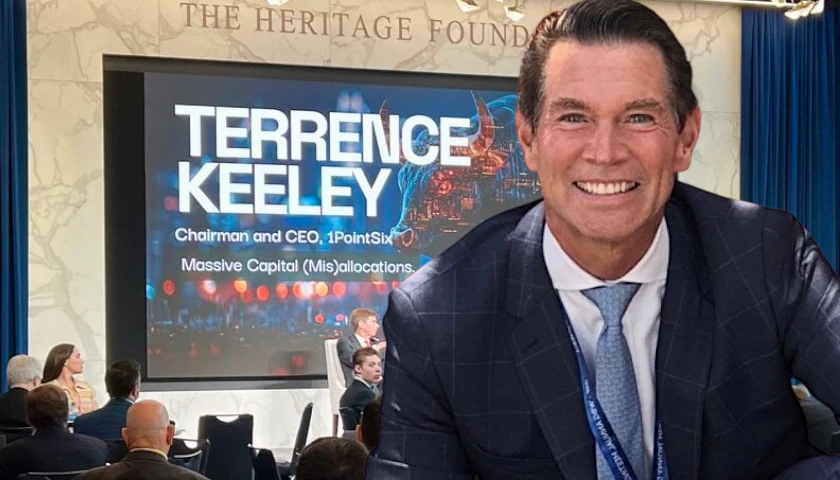

At the Energy Future Forum presented by RealClearEnergyWednesday, Terrence Keeley, author and former senior advisor at Blackrock, argued that ESG is also misallocating resources and doing nothing for the environment it claims to protect.

Read More