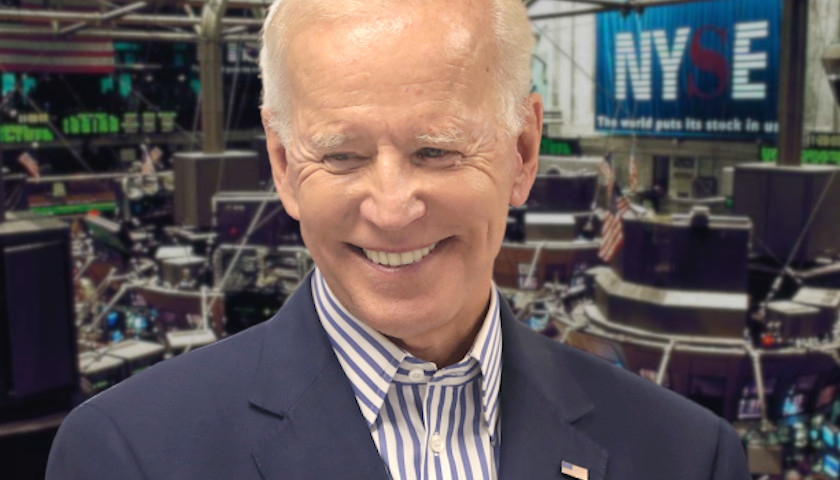

Rising inflation threatens the value of Americans’ retirement savings. Now the Biden administration is finalizing a rule to loosen safeguards under the Employee Retirement Income Security Act of 1974 (“ERISA”) that protect private retirement savings. The new rule, “Prudence and Loyalty in Selecting Plan Investments and Exercising Shareholder Rights,” stems from President Biden’s May 20, 2021, Executive Order on Climate-Related Financial Risk, which directed senior White House advisers to develop a strategy for financing the administration’s net-zero climate goals, including the use of private savings.

Predictably, Wall Street is cheering the prospect of undoing ERISA safeguards. According to one analysis, 97% of comment letters support the proposal. But as I show in my RealClear Foundation report The Biden Administration’s ERISA Work-Around, it’s the remaining three percent that should give the Department of Labor (DOL) cause to rethink its deeply flawed approach.

Under ERISA, retirement savings must be invested for the exclusive purpose of providing retirement benefits. The May 2021 executive order illustrates the very danger that ERISA’s exclusive-purpose rule is designed to guard against. To achieve the goals set out in the order, DOL is instructed to “suspend, revise or rescind” two Trump-era rules designed to uphold ERISA’s exclusive-purpose rule.

Read More