by Bethany Blankley

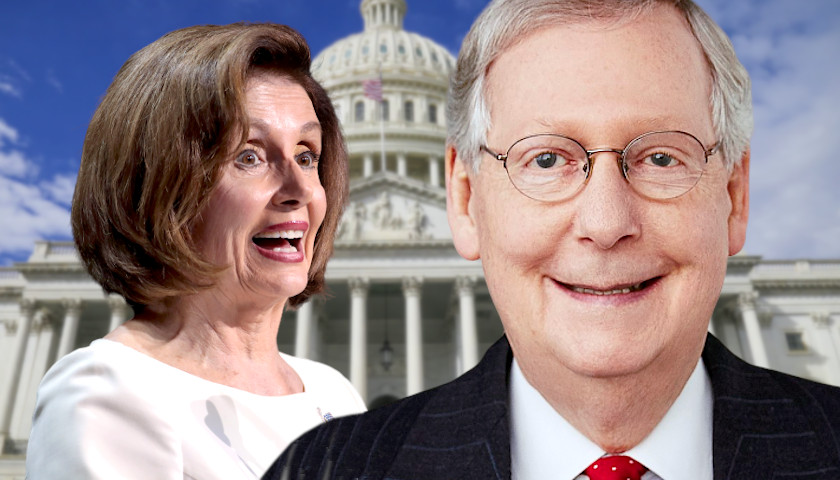

A new Democratic bill proposed by U.S. House Speaker Nancy Pelosi (D-CA), without input from Republicans or the Trump administration is “dead on arrival,” top Republican leaders say.

The White House has said it wants to wait and see how the $3 trillion Congress already allocated will impact the economy and help Americans suffering from the economic shutdown due to the coronavirus.

The House is expected to vote on the bill Friday. Senate Majority Leader Mitch McConnell, R-Kentucky, called the bill “a partisan wish list with no chance – no chance – of becoming law.”

“We’re going to insist on doing narrowly targeted legislation if and when we do legislate again and we may well,” he told reporters.

To limit the spread of the coronavirus, governors issued executive orders in mid-March, effectively shutting down their states’ economies. By the end of April, the national Gross Domestic Product dropped by 4.8 percent, the unemployment rate hit 14.7 percent, and 33.5 million jobs were lost nationwide.

In March, Congress passed three stimulus bills to help alleviate the economic pain. But they could do more harm than good some, critics note, adding another estimated $6 trillion to the national debt, costing taxpayers and future generations much more, according to an analysis by the Cato Institute.

Included in these measures was roughly $300 billion allocated to states, local, territorial and tribal governments. Despite this, the National Governors Association asked for an additional $500 billion and five western Democratic states asked for an additional $1 trillion.

The Democrat’s 1,800-page bill proposes a fourth round of stimulus money, this time allocating an additional $1 trillion to state, local, territorial and tribal governments.

Instead of the previous $1,200 and $2,400 stimulus checks sent to individuals and married citizens, the bill proposes sending up to $6,000 in stimulus checks per household, regardless of citizenship status. It would extend the additional $600 a week in unemployment insurance benefits through January 2021, allocate $175 billion to subsidize rent and mortgage payments, and increase nutrition assistance by 15 percent.

It would suspend student loan payments through September, establish a $200 billion “Heroes Fund” to extend hazard pay to essential workers, and direct $75 billion towards coronavirus testing and contact tracing.

“We must think big for the people now, because if we don’t it will cost more in lives and livelihood later,” Pelosi said. “We’re presenting a plan to do what is necessary to deal with a chronic crisis and make sure we can get the country back to work and school safely.”

But Cato Institute economist Chris Edwards said it’s the wrong approach.

“States are not subdivisions of the federal government. They should tackle their budget challenges by tapping rainy day funds, furloughing nonessential workers, and cutting low-priority programs,” he wrote in an op-ed published by Fox News.

“Supporters of additional federal spending seem to think that states are feeble and unable to fend for themselves,” Edwards added. “But the states have powerful tax bases, rainy day funds, and a large ability to borrow. Local governments are wards of state governments, not the federal government.”

In addition to the $300 billion Congress already provided in aid to the states, the Federal Reserve created a “municipal liquidity facility” to lend money to cash-strapped governments, Edwards noted. The U.S. Treasury Department has also made loans available to states to pay for unemployment insurance benefits. California was the first to take advantage of this offer, accepting more than $300 million to cover roughly 4.5 million claims filed since mid-March.

Texas Public Policy Foundation Senior Advisor Rod Bordelon told The Center Square that, “no amount of general stimulus or bailouts alone can put the American economy back on track. We need business to reopen and ultimately regain full operations. But many businesses have incurred significant and devastating losses and now lack the capital to reopen due to the coronavirus and the resulting government ordered shutdowns.”

Along with a broad coalition of business groups, the TPPF proposed the Workplace Recovery Act (WRA) as a solution to help employers and employees. The WRA outlines providing limited direct federal disbursements only to businesses that have incurred and can demonstrate operating losses as a result of state coronavirus shutdowns. The funds would be used for eligible operating costs and exclude certain expenditures like capital improvements.

TPPF’s executive director, Kevin Roberts, says that immediately halting the payroll tax would have longer lasting effects than going into debt to send stimulus checks.

Tom Donohue, CEO of the U.S. Chamber of Commerce, proposed this in a March 16 letter to Trump, Pelosi and Senate Majority Leader Mitch McConnell.

“From a policy perspective, a payroll tax cut is a far superior approach to sending checks,” Roberts says. “And there’s no reason it can’t be achieved quickly, if all of us – including Congress, the IRS, businesses and their employees – work together to navigate these unfamiliar waters.”

– – –

Bethany Blankley is a contributor to The Center Square.

Photo “Nancy Pelosi” by Gage Skidmore. CC BY-SA 2.0.