by Nick Pope

ExxonMobil announced Wednesday that it has acquired Pioneer Natural Resources in a major deal in the oil and gas industry.

America’s largest oil company is merging with Pioneer, which controls a strong portfolio of assets in the oil- and gas-rich Permian Basin of Texas and New Mexico, in an all-stock transaction valued at about $59.5 billion, Exxon announced. The deal could draw antitrust scrutiny from the Biden administration, which has already demonstrated its distaste for long-term fossil fuel development, according to Axios.

“Pioneer is a clear leader in the Permian with a unique asset base and people with deep industry knowledge,” ExxonMobil Chairman and CEO Darren Woods said of the deal. “The combined capabilities of our two companies will provide long-term value creation well in excess of what either company is capable of doing on a standalone basis,” adding that “as importantly, as we look to combine our companies, we bring together environmental best-practices that will lower our environmental footprint and plan to accelerate Pioneer’s net-zero plan from 2050 to 2035.”

The Permian Basin provides about 40% of U.S. oil production and nearly 15% of the country’s natural gas, according to the Federal Reserve Bank of Dallas. Prior to its acquisition, Pioneer owned one of the most robust portfolios of untapped extraction areas in the Permian Basin, the WSJ reported.

The Permian Basin provides about 40% of U.S. oil production and nearly 15% of the country’s natural gas, according to the Federal Reserve Bank of Dallas. Prior to its acquisition, Pioneer owned one of the most robust portfolios of untapped extraction areas in the Permian Basin, the WSJ reported.

“The combination of ExxonMobil and Pioneer creates a diversified energy company with the largest footprint of high-return wells in the Permian Basin,” Pioneer CEO Scott Sheffield said of the deal. “The consolidated company will maintain its leadership position, driving further efficiencies through the combination of our adjacent, contiguous acreage in the Midland Basin and our highly talented employee base, with the improved ability to deliver durable returns, creating tangible value for shareholders for decades to come.”

The Pioneer deal marks Exxon’s largest, most significant business transaction since it acquired Mobil in 1999. The two companies were discussing a merger as early as April, according to The Wall Street Journal, and rumors of a nearly-completed deal circulated last week.

The finalized merger could spur a flurry of mergers in the natural gas industry, according to the WSJ. Drilling for new oil discoveries is no longer an especially popular model with investors, a situation that has left many companies with few options other than purchasing smaller, rival companies to extend their runways.

Pioneer and the White House did not respond immediately to requests for comment. The Federal Trade Commission declined to comment, citing its general policy of refraining from comment on proposed mergers or acquisitions.

– – –

Nick Pope is a reporter at Daily Caller News Foundation.

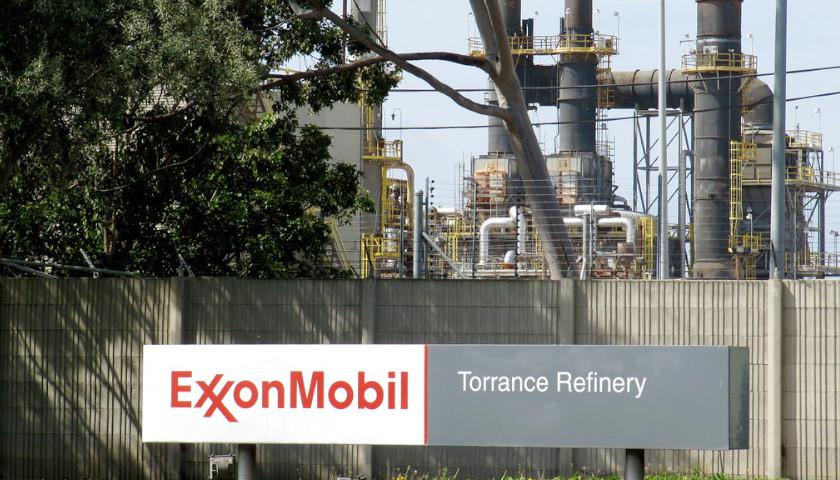

Photo “ExxonMobil Refinery” by waltarrrrr. CC BY-NC-ND 2.0.